Jan 22, 2025

The Economics of Sneaker Reselling: An Investors Digest

Newsletter Highlights

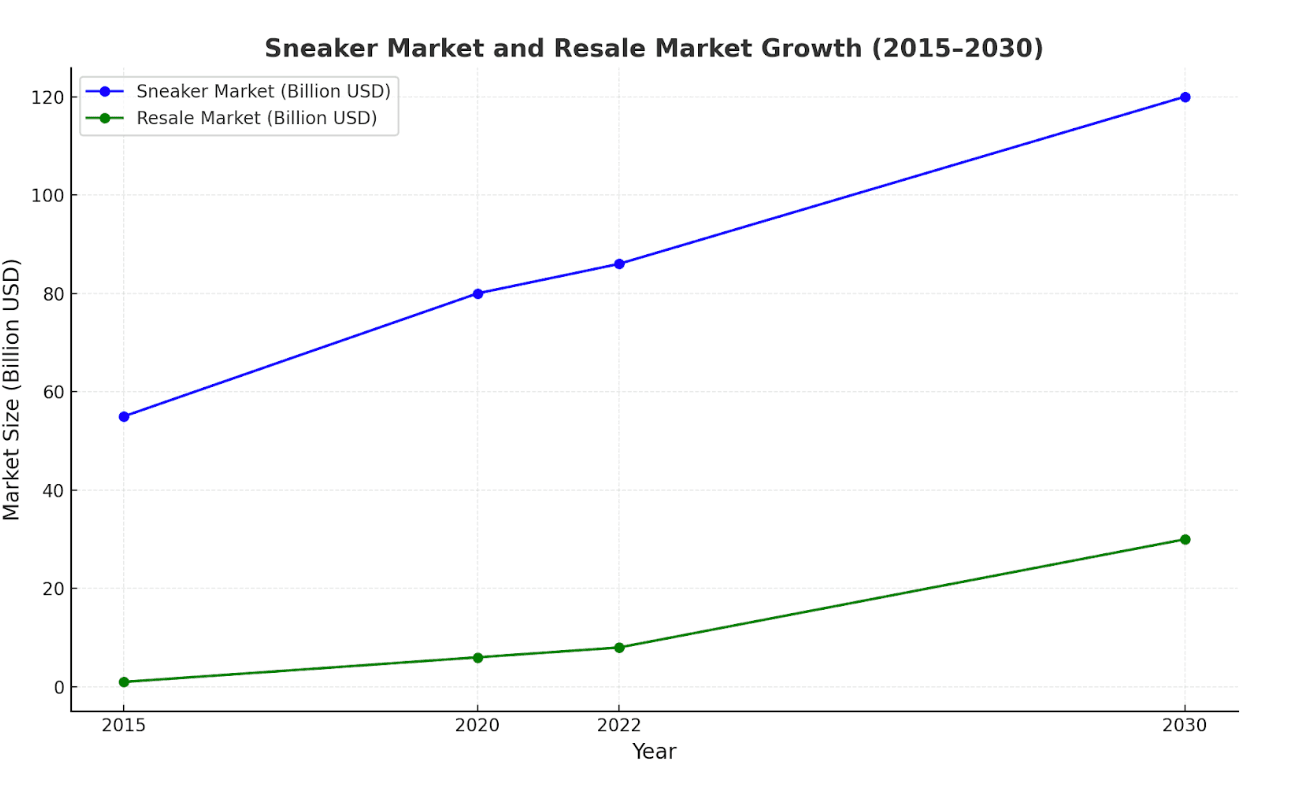

- Market Growth: The sneaker resale market is projected to grow to $30 billion by 2030, driven by exclusivity and cultural relevance.

- Top Performers: Iconic sneakers like the Nike Air Mag and Travis Scott Air Jordan 1 offer over 300% ROI in the resale market.

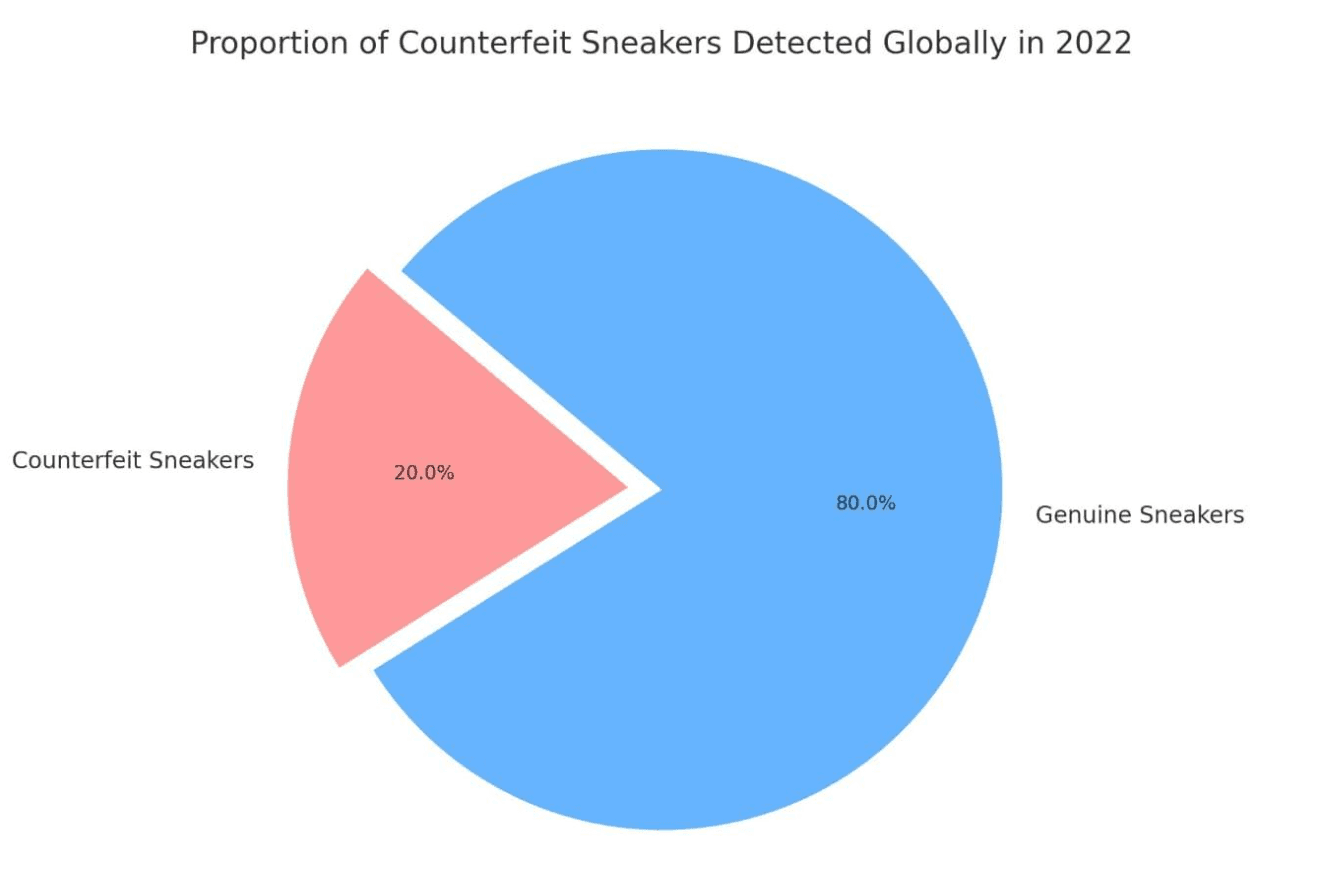

- Risks to Consider: Market volatility, counterfeiting (about 20% of sales worldwide), and platform fees of up to 15%.

- Investor Appeal: The entry cost and margin are lower in the sneaker-selling market, where 40% of profitable resellers earn more than $10,000 annually.

- Balanced Outlook: Sneaker reselling can be lucrative, but it requires strategic planning and taking stock of risks.

The Economics of Sneaker Reselling: An Investors Digest

Sneaker reselling has grown into one of the fastest-moving micro-economies in the world, exciting both sneakerheads and investors. Exclusive product collaborations and rare launches have transformed sneakers into intriguing buy-and-hold assets. According to Cowen Research, the sneaker resale market value globally amounted to $6 billion in 2020 and is expected to rise to $30 billion by 2030.

Supply and demand form the crux of this story. Costly production runs with a cultural context set prices at massive heights, sometimes fetching up to 500% of their net selling value. For the enthusiasts and investors prepared to invest in Laborious antecedents, sneaker reselling promises high gains.

This article will discuss the economics of sneaker reselling, provide an overview of the forces shaping markets, and provide evidence-based insight into prospective investor activity.

The Sneaker Market: A Billion-Dollar Industry

As the world's most lucrative sneaker market, it was valued at $86 billion within the fashion and lifestyle sector in 2022 and is expected to increase its revenue to $120 billion by 2026. Notably, alongside retail sales, the most significant boost in this market growth comes from sneaker resale. It is little surprise that platforms such as StockX, GOAT, or Stadium Goods thrive on the hype of the search for rare and exclusive sneakers, creating a healthy secondary market for all concerned.

Limited-edition releases from leading brands such as Nike, Adidas, and Jordan comprise some of the major contributors to this phenomenal growth. A classic example is the Air Jordan 1 "Chicago" 1985 sneaker, which sold at retail for $65 back in the day but now retails for well over $15,000 in resale markets, proving the endless profit possibilities in this business.

Projected sneaker market and resale market growth between 2015 to 2030

Economics of Sneaker reselling

To have a good sneaker flip, you must know how to play the game of supply and demand. Most sneaker show limited production to complement, translating into good consumer demand and thus propelled the resale price to an exorbitantly high figure. There is a niche within the reselling economy whereby individuals buy it at retail prices and sell it again at excellent profit margins.

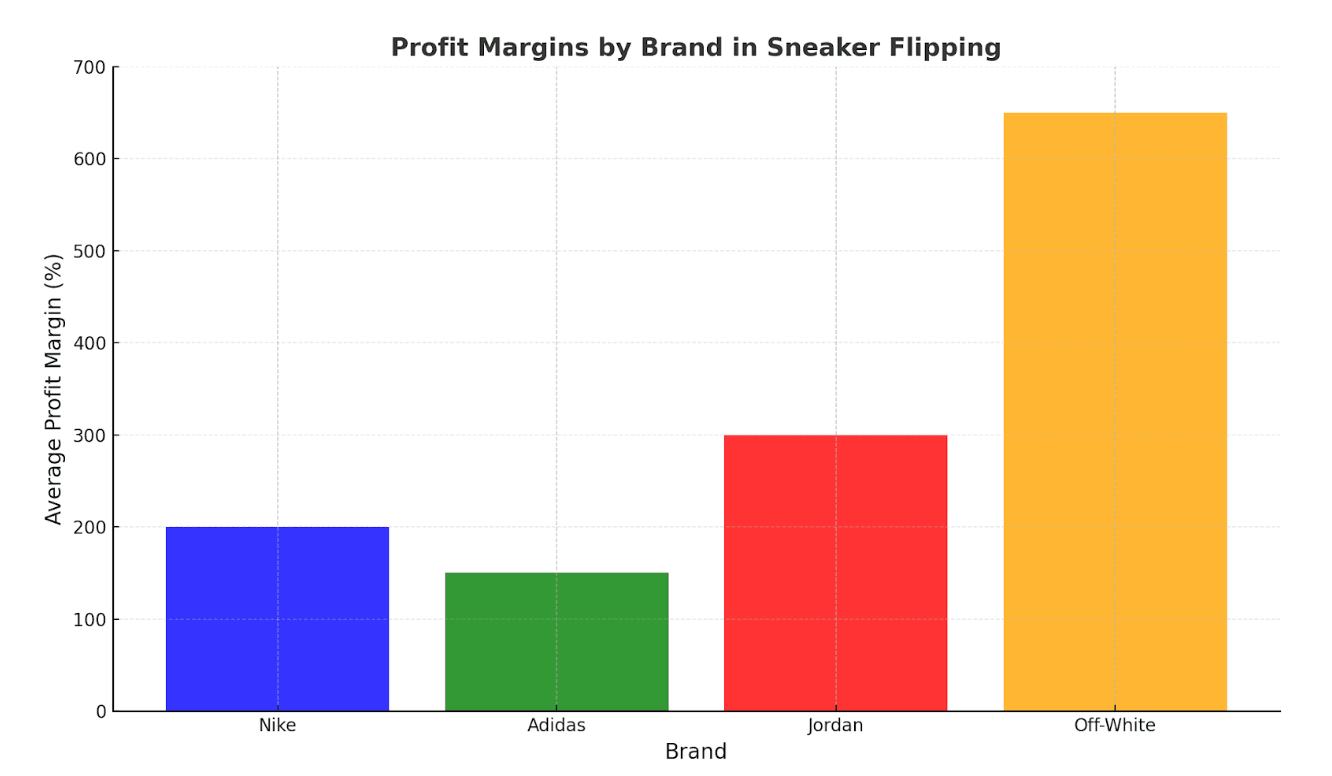

Profit margins vary by brand and exclusivity.

For sneaker resellers, profit gains are usually between 30% and 100%, depending on the brand, model, and exclusivity. For example:

- Nike Air Jordan 1 Retro High OG: Retail $170 → Resale $450 (164% margin).

- Adidas Yeezy Boost 350 V2: Retail $230 → Resale $600 (161% margin).

- Off-White x Nike Dunk Low: Retail $200 → Resale $1,500 (650% margin).

Average profit margins by brand and sneaker flipping

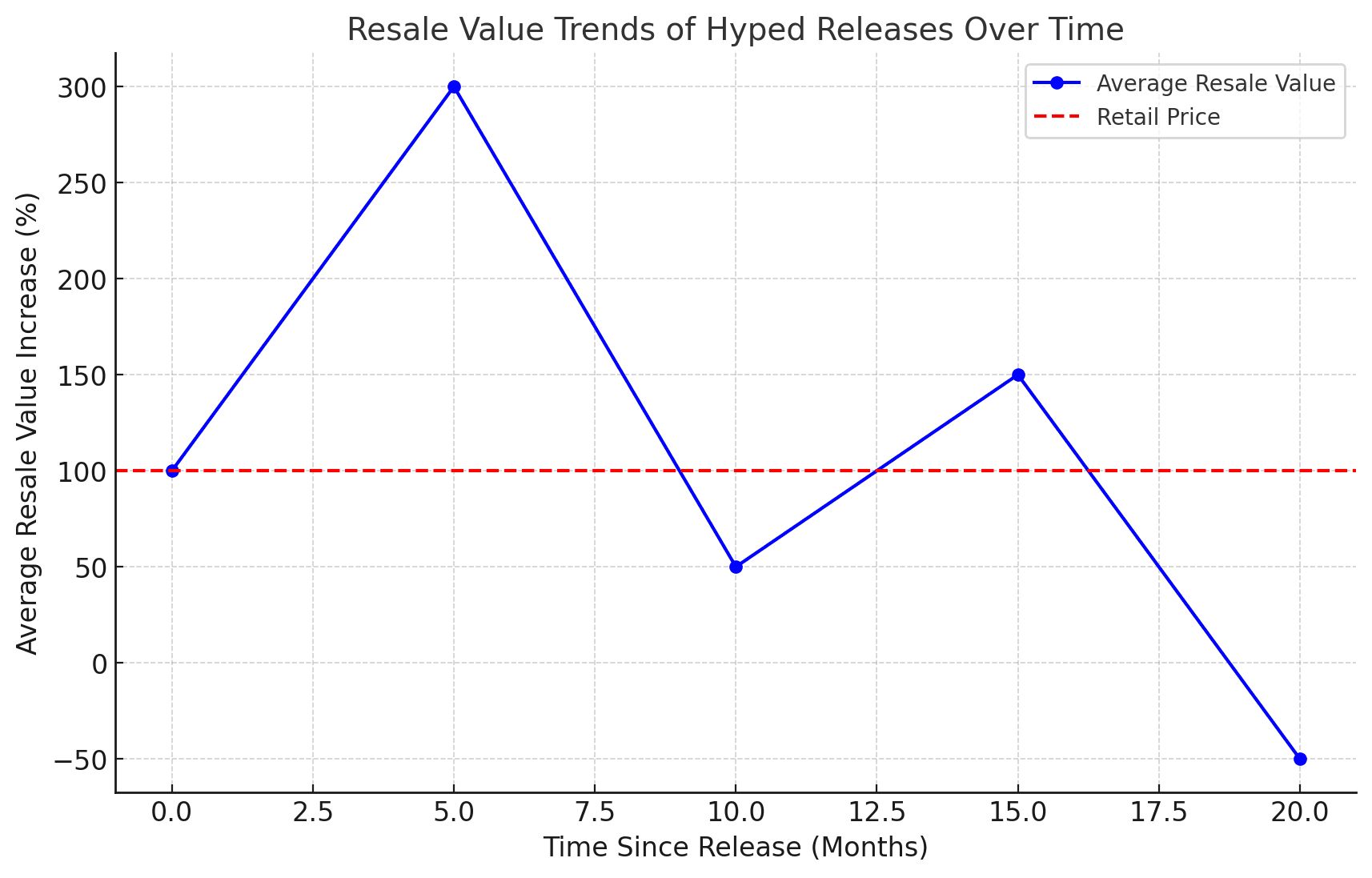

What affects the profitability of sneaker reselling? Timing, the hype generated in advertisements, and the reseller's choice of online outlet (like StockX, eBay, or GOAT) determine profitability. This is one of the risks in the market, as one can lose out if there is an oversupply or a change in trend.

Key Factors Influencing the Resale Market

The market for sneaker resale is heavily influenced by a well-known set of elements that define a sneaker's value and resale potential. Grasping these dynamics becomes paramount for investors and resellers targeting maximum profits.

1. Limited supply and exclusivity

Brands have successfully created an artificially limited supply of sneakers. The Travis Scott x Air Jordan 1 High, priced at $175, marked approximately 38,000 pairs approved into its units, increased demand, and offered resale prices greater than $1,000.

2. Celebrity Endorsements and Collaborations

Sneaker release prices associated with celebrities or cultural icons will tend to be higher than usual. All collaborations like Kanye West (Adidas Yeezy) and Virgil Abloh (Off-White x Nike) have multiplied resale prices over retail.

- Statistic: StockX reported that celebrity-endorsed sneakers show an average 40% price premium over shoes that are not celebrity releases.

3. Cultural Trends and Hype

Sneakers that reflect current cultural trends or get much online attention are good when sold in secondary markets. The forums and social media platforms buzzing around the influencers will raise the hype and demand.

Resale value trends of hyped releases over time

4. State and Authenticity

The sneaker's state and authenticity are heavily set in what determines the resale market. Counterfeiting damages trust, pushing platforms like StockX and GOAT to have stringent authentication verification processes.

- Statistic: GOAT stated that in 2022, it set a record in verifying over 1 million sneakers, ensuring quality and authenticity to a buyer for buyers who purchase platforms.

5. Timing

Timing a sale can significantly affect profit margins. Selling items as soon as they come out usually yields higher profits, as demand is at its peak while high. On the other end of the spectrum, models for years can significantly profit on the temple: The Nike Air Mag (Back to the Future) auctioned off in 2011 for $6,000 is now valued at over $50,000.

Risks and Challenges in Sneaker Reselling

Though sneaker reselling could provide lucrative outcomes, it is not without risks. Potential investors face some challenges in minimizing losses and making salable decisions regarding market entry.

1. Market Volatility

Sneaker sales are volatile. Trends can change quickly, making today’s hot item tomorrow’s loss."

- Statistic: A 2023 StockX report indicated that nearly 15% of sneakers released within the year went down in value within six months.

2. Counterfiet Sneakers

The excitement about sneaker reselling has invariably given rise to counterfeit products, and differentiating between the original and fake ones can be an uphill task, especially for the new entrants.

Counterfeit sneakers detected globally in 2022

3. High Platform Charges

Resale platforms like StockX, GOAT, and eBay charge transaction fees that range from 9% to 15%. Such charges can dramatically reduce profit margins on sneakers, especially for lower-value ones.

4. Storage and Maintenance Expenses

Keeping sneakers in pristine condition is essential to retain their value. Poor storage may lead to a greater risk of wear and tear and, therefore, a decreased resale price.

- Statistic: Sneakers lose 25% of average resale value if not kept in their original box or "deadstock" condition.

5. Legal and Ethical Issues

Anti-scalpCertain jurisdictions are already enacting anti-scalping legislation to combat the market. Resellers caught violating these laws may present a challenge to them.

Investor’s Perspective: Is Sneaker Reselling Worth It?

Sneaker reselling is a lot more than that. It is a potential investment in diversifying your portfolio. Like any other investment, the investor must weigh all the risks, market trends, and financial goals.

Benefits of Sneaker Flip

- High Returns Potential: As stated before, sneakers can give more than a 300% profit margin. For example, buying a sneaker may cost around $200, and one can sell it for around $600.

- Entry-Level Investment: There are lower barriers to entry than in earlier forms of investment, such as stock trading and buying property. This makes sneaker reselling available to all those with little money.

- Passive Income: After shoes are bought, they can be resold anytime during periods of high demand, thus providing passive income.

The Cons of Sneaker Reselling

- Market volatility: Like the speculative market, the sneaker resale industry can also wobble at different times, throwing others off balance within the hype cycle and making fluctuating prices unpredictable.

- Time-consuming: It is very time-consuming because it requires acquiring rare sneakers, carefully monitoring resale trends, and waiting for the moment when it is most viable to sell. Dedication to this trade, therefore, requires firmer knowledge of the market.

Selling costs: Include portal fees, shipping, and other transaction-affiliated expenses, ensuring a very high profit percentage is consumed. As stated, it can go as high as 15%, pushing profitability further down.

Is It Worth It?

Sneaker reselling can be a side income-earning proposition and even a full-time one for investors with wide eyes open but who have taken risks regarding market trends. However, the cost involved must add to awareness and the truthfulness of the market's volatility.

- Statistic: According to the 2023 Sneaker Investment report, 40% of successful resellers make over $10,000 annually, and the rest see little profit or losses.

Sneaker reselling is best entered when you make a small initial investment, as you brim with experience, insight, or knowledge. In the long run, this niche investment can yield good returns if you are cautious and informed.

Conclusion: A Sneaker Flip or Financial Trip?

The sneaker-selling market is growing fast to become a wholly dynamic investment domain, a cultural and commercial mix. It offers promises of high rewards, hugely reflected in resale values like the Nike Air Mag, which shot up to $50,000 at its peak. However, it does not guarantee easy money. Before diving into this fast-paced world, investors must consider risks such as market volatility, counterfeits, and platform fees.

Savvy investors who know how to track trends, get limited releases, and cut down on costs will be well rewarded in this space. But, like with any investment, research, strategy, and flexibility to change with the market are the keys to success. Newbies can start small and learn the ropes of the game before growing as they become comfortable and better skilled.

By knowing the opportunities and challenges, investors can determine whether reselling sneakers aligns with their objectives and whether the comfort level aligns with risk.

Step Into the World of Sneaker Reselling Success!

Do you want to start a reselling business that channels your love for sneakers? Whatever your passion for sneakers-from casual fans to seasoned professionals, there is a niche in the dynamic sneaker resale market for everyone. Start small, stay informed, and let your passion for sneakers guide you toward reselling success. Dive into this dynamic market today with insights from KickIQ.