Mar 18, 2025

The Coming Collectible: A Data-Driven Guide for Investors

The Coming Collectible: A Data-Driven Guide for Investors

In the short term, how do limited releases of specific sneakers affect the sneaker ecosystems regarding resale/redemption prices?

Key Takeaways:

1. Sneaker Resale Market Growth

As limited releases, cultural relevance, and reinvigorated platforms such as StockX and GOAT keep growing, the sneaker resale market is expected to reach $30 billion by 2030.

2. High Returns on Investment (ROI)

Return on numbers and figures is quite surprising, especially if assets like Air Jordan 1 Dior can go as high as 450% returns, whereas even gold or S&P 500 cannot.

3. The Power of Scarcity

Exclusive sneakers, such as those with production below 10,000 units, tend to resell within 30 days at a 100-500% price differential.

4. Opportunities and Risks

Investors are exposed to advantages such as high shoe resale profit margins and a worldwide appetite for sneakers but also face difficulties such as the cyclical nature of the sneaker market, fakes, and storage issues.

5. The Role of Influencers

Releases associated with artists such as Travis Scott or Kanye West create lots of hype, guaranteeing that such products would perform well in the resale market.

What was once a subculture of sneaker enthusiasts has now blossomed into a global investment craze. The world of sneakers, once underappreciated, has evolved into a market that blends fashion, culture, and finance. Limited edition sneakers, once mere fashion statements, are now treated as art objects, some reaching price ranges typically associated with economically viable assets.

According to Scott Cutler, CEO of StockX, this sneaker resale market is quickly becoming an asset class. The global sneaker resale market is expected to register more than $30 billion in revenues by 2030, driven by factors such as hype, the rarity of the products, and emerging players such as StockX and GOAT.

Dunk High "Wu-Tang"

CREDIT: NIKE

In this guide, we delve into the analysis of limited sneaker releases and their continued impact on the resale prices of sneakers and the sneaker market. Whether you're a fan or an investor, these market dynamics can generate significant income in the evolving sneaker market.

Market Overview

The culture and the economy have embraced the sneaker part of the economy, which was not the case a few decades ago, as it has moved from being an everyday shoe. The worldwide sneaker market was estimated at $79 billion in 2021 and is projected to reach $120 billion by the year 2026, which shows its growing popularity.

Moreover, the sneaker resale market alone is projected to attain $30 billion by 2030, owing to limited releases and resellers who have become collectors. As the rudimentary economy theory describes, John Donahoe, the former CEO of Nike, earlier called investors’ attention to the ever-growing sales of limited editions.

Role of Limited Releases

The extremely popular Air Jordan 1 Dior (which sells for more than $8,000 on the secondary market) and the Nike Air Yeezy 2 "Red October," which can be purchased for $5,000–$10,000 on resale platforms, provide examples of how painful marketing pushes hype and prices.

An infographic from StockX illustrates that sneakers produced in quantities of less than 10,000 pairs experience 100–500% average growth in resale value within 30 days after release.

Limited Releases and Their Impact

The Power of Scarcity

The sneaker business thrives on limited releases, which create a sense of exclusivity and drive demand. The scarcity of such items compels consumers to make quick purchases, increasing their resale value. A prime example is the Air Jordan 1 model designed for Dior in July 2020. With only 8,500 pairs produced worldwide, the shoes were initially sold at $2200, but within a few weeks, their average resale price skyrocketed to between $8000 and $10000.

Social Impact and Trends

Limited edition trainer sales are greatly enhanced by celebrity endorsement and media coverage. For instance:

Travis Scott x Nike Air Jordan 1 High "Cactus Jack"

- Retail Price: $175

- Resale Price (within 30 days): $1,300

- Year-To-Date Growth: 550%

According to fashion trends and social media practices, the value of specific limited-edition sneakers increases tremendously with the activities of sponsored celebrities. Bjorn Gulden, the CEO of Adidas, mentioned that sneaker culture is all about narratives and scarcity. For example, a Travis Scott x Nike Air Jordan 1 High ‘Cactus Jack’ model that went on sale for $175 ended up selling for $1,300 just a month later.

Travis Scott x Nike Air Jordan 1 High ‘Cactus Jack

CREDIT: Hypebeast

Short-term Valuation Trends

Evaluating valuation trends across shorter time horizons is vital to understanding short-term dynamics.

Release Details: The most famous and iconic Nike Dunk Low SB 'Pigeon' was released in 2005 as a collaboration between Nike and Jeff Staple, a renowned sneaker designer. The number of pairs was limited to only 150, making it a coveted and rare sneaker in the market.

Original Retail Price: $200

Resale Price Change over Time:

- Day 1: $1,200

- Day 30: $3,000

- Year 1: $10,000

This change clearly illustrates how scarcity and cultural cache enhance resale prices. Lastly, shoes of such nature can be classified into two categories: purely enjoyment objectives and financial investments similar to stocks or paintings.

Data Visualization Chart

Graph Idea: A one-year graph tracing the increase in the resale value of the 'Pigeon' Dunks.

Bar Chart Objective: A graph showing the return on investment on three sneakers:

- Air Jordan 1 Dior – 450%

- Travis Scott x Nike – 550%

- Nike Dunk Low SB 'Pigeon' – 1000%

This example highlights the characteristics of limited releases and provides the audience with analytical insights.

the variation in the resale price multipliers for the chosen sample of limited-edition sneakers.

The following bar graph shows the variation in the resale price multipliers for the chosen sample of limited-edition sneakers. Resale price multipliers indicate how much higher the average resale price is as a percentage relative to the initial selling price. A higher multiplier suggests a more profitable investment in the market after the initial sale.

The Future of Sneaker Investments: Long-Term Trends and Opportunities

The sneaker industry is more than just a fashion statement; it has become an investment sector. With the worldwide sneaker market expected to reach over $120 billion by 2026, investors focus more on specific resale categories that perform well, like limited collaborations and retro releases.

Long-term Growth Projection

According to a Cowen Equity Research report, the sneaker resale market, valued at $6 billion in 2020, will reach an astonishing $30 billion in 2030. Digital platforms such as StockX and GOAT are the primary reasons for this growth, as they help quickly tap into this market for investors globally. Such platforms enhance pricing transparency, further establishing sneakers as an asset class.

The Rise of Brand-Specific Opportunities

Nike, Jordan, and Adidas Yeezy still lead the pack regarding resale value. For instance:

The limited-release Air Jordan 1 sneaker matured in worth by an average of 27% yearly, performing better than conventional investment vehicles like gold (7–10% in a decade of averaging).

During the height of the craze sparked by Adidas Yeezy mods like the Yeezy Boost 350, resale prices increased by more than 400%.

Case Study: Sustainability in Sneakers

The increasing emphasis on sustainability has benefited larger companies such as New Balance and smaller designer sneaker brands. New Balance’s Made in the USA line is all about handcrafted quality, and some models return over 200% in resale markets. Such a trend suggests a growing demand by consumers for responsible and durable goods, which might even add value for investors with a longer horizon.

Investment Stability vs. Hype

The data recorded on StockX reveals that although there may be some price volatility for newsworthy releases in the shortest time, core shoes like the Air Force 1 and the Converse Chuck Taylor tend to offer steady but lower returns. They are a form of ‘safe’ investment, similar to the treasury bonds in the Money markets, for risk-averse investors who are not against making investments but want to earn them slowly.

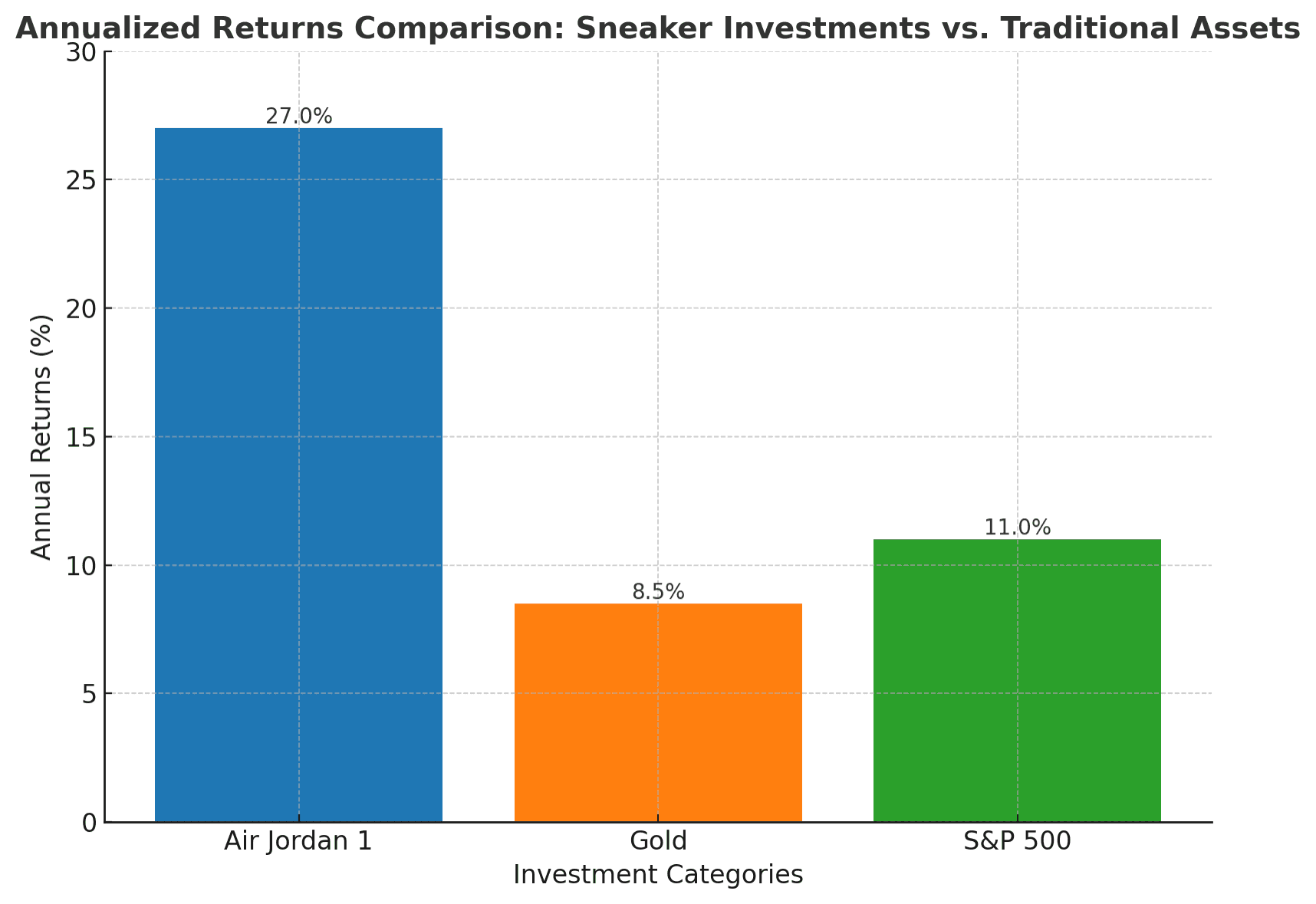

Annualized Returns Comparison: Sneaker Investments vs. Traditional Assets

graphic that compares annualized returns on investment in sneakers (Air Jordan 1), gold, and the S&P 500.

Here is a graphic that compares annualized returns on investment in sneakers (Air Jordan 1), gold, and the S&P 500. This graph more clearly depicts how the resale market of legendary footwear has done better than the conventional assets that one would invest in over the past few years.

Analyzing the Data: Sneaker Investments vs. Traditional Assets

The underlying statistics from the melding exhibit reveal a significant pattern. Investment in sneakers, particularly hyped factions such as the Air Jordan 1, has beaten the return on investment of conventional assets like gold or even the S&P 500 Index for longer than within the timeframe. This enhances the increasing perception of sneakers as a commodity for speculation. Here's what the numbers reveal:

1. High Annualized Returns for Sneakers:

The phenomenon of sneaker reselling is particularly ravaging, with a return per average of 25-30% with a sneaker made like Air Jordan 1. The main reason for this is the combination of scarcity and cultural value. Limited edition shoes manufactured by companies such as Nike and Adidas tend to sell out quickly, creating an imbalance of demand and supply, hence the increased resale value for these sneakers.

2. Gold's Steady but Modest Growth:

Traditionally viewed as a safe-haven asset, gold has provided steady annual returns of 6-8% over the last decade. While reliable, its growth pales compared to the surging returns of the sneaker market, particularly during periods of cultural hype.

3. S&P 500’s Performance:

The S&P 500 index, a combination of various stocks, has given an average annualized return of 10-12%. This is good, but the sneaker resale business, more so with limited or rare editions, does have more drastic short-term returns than this.

4. Cultural and Emotional Value:

Apart from making Money, sneakers have an emotional and cultural impact, mainly because of celebrities and sports achievements connected to them. This drives their dem, further making sneakers a profitable investment.

5. Market Dynamics Favoring Sneakers:

Digital Platforms: The emergence of platforms such as StockX, GOAT, and even eBay has simplified purchasing and selling sneakers, thus increasing their liquidity and transparency.

Expanded Demographics: The Millennials and Gen Z populations that drive the sneaker market are beginning to regard sneakers as both fashion and investment.

Broader Implications

This could indicate an evolving investment landscape, particularly with younger investors focusing on cultural relevance and faster investment turnarounds than mainstream investment vehicles. As the sneaker industry grows over time, we might witness even higher levels of uniformity and regulation, further reinforcing its status as an economic sector.

Do you have data or feedback about this article you'd like to share?