Mar 24, 2025

Sneaker Bots: The Arms Race Between Retailers and Automation

Sneaker bots, automated software programs designed to rapidly purchase limited-edition sneakers, have become both a boon and a bane for the sneaker industry. While bots fuel the $11.5 billion resale market by creating artificial scarcity and driving up prices, they also disrupt fair access for genuine buyers and strain retailers' infrastructure. To counter these challenges, retailers are investing heavily in anti-bot technologies, creating an ongoing arms race between bot developers and brands. Here’s a deep dive into the measures retailers are taking to combat sneaker bots, supported by data visualization and industry insights.

The Sneaker Bot Problem

Impact on Retailers

Sneaker bots flood retailer websites during high-demand releases, often crashing servers and preventing genuine customers from completing purchases. For example, during the release of the Adidas Yeezy Boost 350 V2 "Zebra," overwhelming bot traffic caused Adidas' website to crash within minutes, leaving thousands of buyers frustrated.

Nike’s SNKRS app faces similar challenges, with bot attacks making up 10–50% of entries during popular launches globally. The company reports blocking up to 12 billion bot attempts monthly.

Impact on Consumers

Bots dominate limited-edition sneaker releases, creating artificial scarcity that inflates prices on secondary markets like StockX and GOAT. This forces genuine buyers to pay exorbitant resale prices or miss out entirely. A 2019 drop at Bodega saw 60% of sales go to bots, with one user securing hundreds of pairs while loyal customers walked away empty-handed.

Retailers Fighting Back: Anti-Bot Technologies

Retailers are deploying a range of innovative technologies and strategies to combat sneaker bots:

1. AI-Powered Behavioral Analysis

Retailers like Nike and Adidas use machine learning (ML) algorithms to analyze large datasets of user behavior metrics—such as mouse movements, session duration, keystrokes, and browsing patterns—to identify bot activity. These systems adapt over time to detect increasingly sophisticated bots.

Lucy Rouse, Vice President of Nike SNKRS, emphasized the importance of AI in combating bots: "AI-powered systems continuously learn from new patterns and update detection strategies accordingly".

2. CAPTCHA Systems

CAPTCHA challenges remain one of the most widely used anti-bot measures. Retailers like Shopify Plus have implemented H-Captcha during major releases to disrupt bot operations. This tactic has proven effective in allowing manual users to secure exclusive sneakers while slowing down automated scripts4.

3. Virtual Waiting Rooms

Virtual waiting rooms act as checkpoints between a website’s landing page and its purchase path. These systems filter out bots by running visitor identification checks before allowing them to proceed with purchases. Ticketmaster reports blocking over 13 billion bots using Queue-it’s virtual waiting room technology.

4. Raffle Systems

Raffle systems have become a popular method for thwarting bots during limited-edition releases. By randomly selecting winners from a pool of entries, retailers provide fairer access for genuine buyers while reducing bot interference. However, bot developers have adapted to this approach over time.

5. Post-Sale Audits

Retailers conduct post-sale audits to identify suspicious activity, such as multiple purchases from the same IP address or accounts flagged for unusual behavior. Nike has updated its terms of service to include clauses that allow it to cancel orders deemed suspicious and charge restocking fees to deter botters.

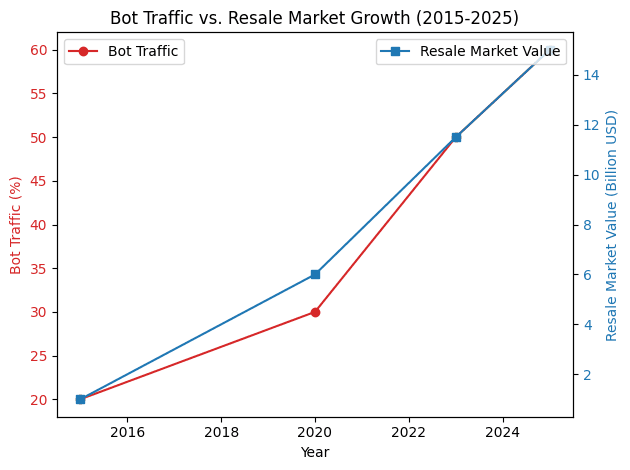

Bot Traffic vs Resale Market Growth

The chart below illustrates the correlation between increasing bot traffic and the growth of the sneaker resale market:

Bot Traffic vs Resale Market Growth Over Time

- Alt Text: "Chart showing bot traffic percentages alongside sneaker resale market growth from 2015–2025."

- Caption: "Bot Traffic vs Resale Market Growth Over Time."

- Meta Description: "Explore how increasing bot traffic correlates with the growth of the sneaker resale market."

Challenges in Anti-Bot Measures

Despite advancements in anti-bot technologies, retailers face significant challenges:

- Adaptation by Bot Developers: As retailers improve their defenses, bot creators develop more sophisticated tools capable of bypassing detection systems.

- Cost: Implementing advanced anti-bot measures is resource-intensive and costly.

- False Positives: Aggressive anti-bot systems can mistakenly flag genuine customers as bots, alienating loyal buyers.

The Future of Anti-Bot Technologies

The fight against sneaker bots is far from over. Retailers are exploring new solutions such as blockchain-based authentication systems and direct-to-resale platforms that integrate secondary sales into their own ecosystems. Legislation like the Stop Grinch Bots Act aims to outlaw automated purchasing practices entirely.

John Donahoe, CEO of Nike, acknowledged the ongoing challenge: "Anti-bot technology is part of the solution, but we need to double down our efforts".

Sneaker bots have reshaped the industry by fueling resale market growth while creating significant challenges for retailers and consumers alike. As brands invest in advanced anti-bot technologies and governments consider stricter regulations, the future of sneaker botting remains uncertain.

For now, retailers must strike a delicate balance between deterring bots and maintaining fairness for genuine buyers—a challenge that will continue shaping the sneaker industry for years to come.