Mar 23, 2025

Nike's Sales Decline: A Deep Dive into the Challenges Facing the Global Giant

Nike, the world’s largest sportswear brand, is facing a significant downturn in sales as it grapples with macroeconomic pressures, changing consumer preferences, and fierce competition. The company’s Q3 fiscal 2025 earnings report revealed a 9% year-over-year revenue decline, with particularly sharp drops in China and North America—its largest markets. This article explores the reasons behind Nike's declining sales, compares its recent performance to previous years, and highlights the challenges ahead for the iconic brand.

The Numbers: A Clear Downward Trend

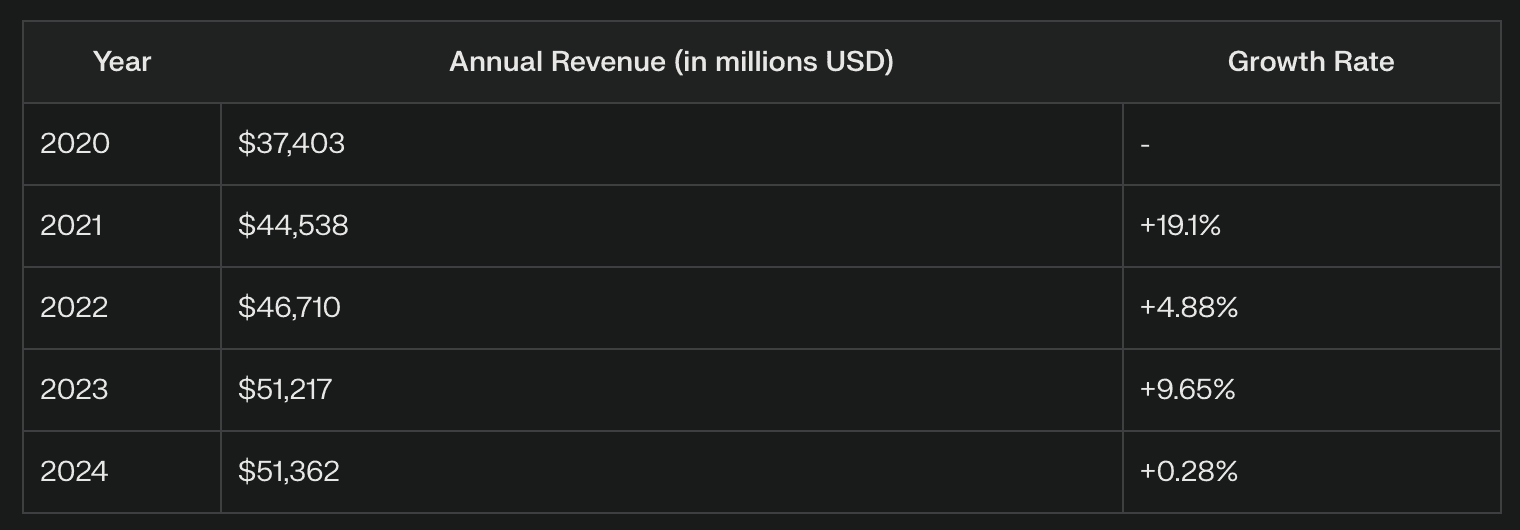

Annual Revenue Overview (2020–2024)

Nike's annual revenue has shown steady growth over the years, but cracks are starting to appear. While fiscal 2024 revenue increased slightly to $51.36 billion (up 0.28% from $51.22 billion in 2023), this growth pales in comparison to the 9.65% jump seen between 2022 and 2023. The slowdown reflects mounting challenges in key markets.

Annual Revenue (in millions USD)

Nike Annual Revenue (2020-2024)

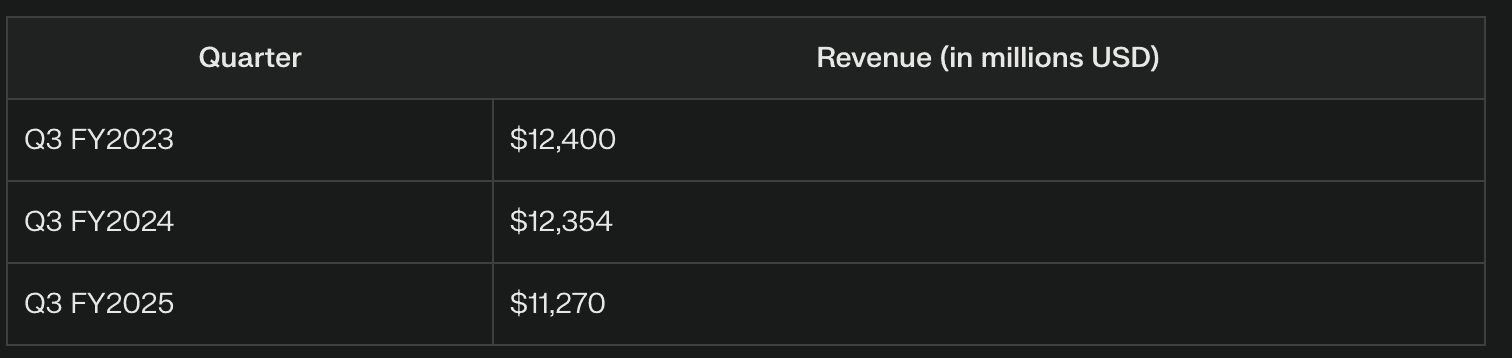

Quarterly Revenue Comparison (Q3)

The quarterly data paints an even grimmer picture. Nike’s Q3 revenue for fiscal 2025 fell to $11.27 billion—a steep 9.3% drop compared to $12.4 billion in Q3 of fiscal 2024.

Revenue (in millions USD)

Quarterly Revenue Comparison (Q3)

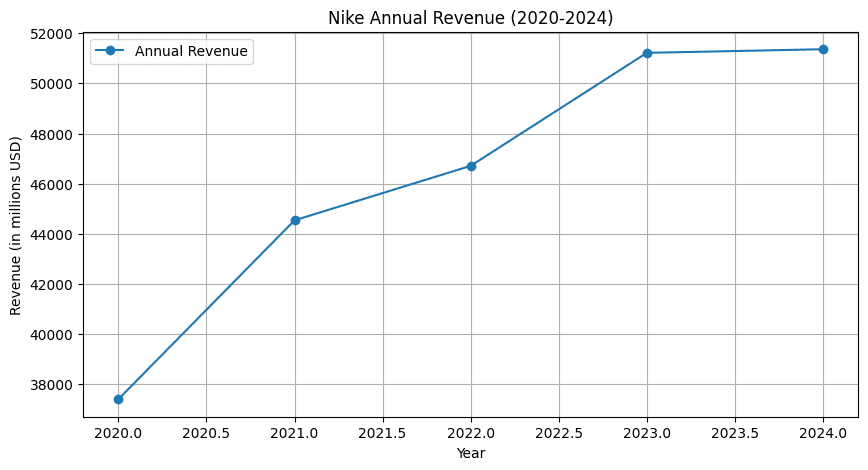

Nike Annual Revenue 2020 - 2024

Nike annual revenue 2020-2024

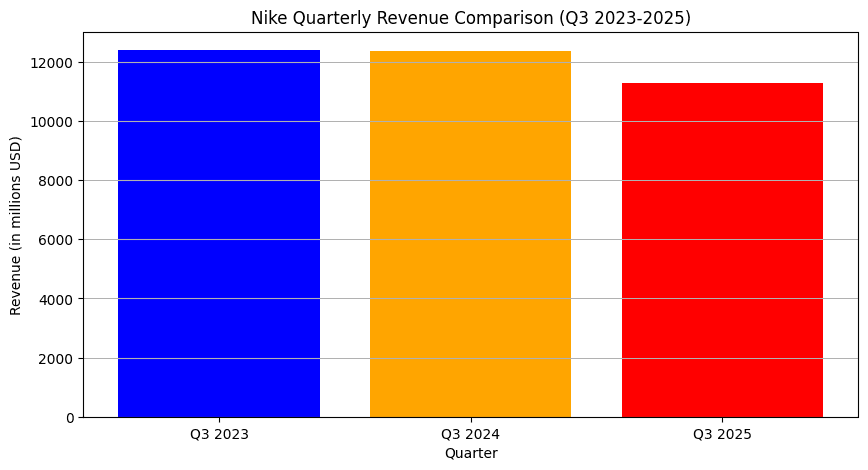

Nike Quarterly Revenue Comparison Q3 2023-2025

Nike Quarterly revenue comparison (Q3 2023-2025)

Key Challenges Driving Declines

1. Weak Performance in Key Markets

- China: Nike’s revenue in China fell by a staggering 17% due to slower economic recovery and reduced consumer spending on discretionary items like sneakers.

- North America: Sales dropped by 4%, driven by weaker demand as consumers shifted toward more affordable options amid inflationary pressures.

Gabrielle Fonrouge of CNBC notes that “emerging competitors like Hoka and On are capturing market share with innovative running shoes at competitive price points.”

2. Inventory Management Issues

Nike has struggled with excess inventory across its classic franchises such as Air Force 1 and Air Jordan 1. While inventory levels declined by 2% year-over-year due to aggressive markdowns and liquidation efforts, these actions have hurt gross margins.

Matthew Friend, Nike CFO, commented: “We are repositioning Nike Digital within an integrated marketplace... reducing markdown rates and shifting closeout liquidation to our factory stores.”

3. Digital Sales Decline

Nike’s digital sales—a key growth driver during the pandemic—fell by double digits in fiscal Q3 of 2025. In China alone, digital sales plummeted by 29%, reflecting a broader trend of waning online traffic and promotional activity.

Strategic Missteps and Competitive Pressures

Nike’s decision to reduce partnerships with traditional retailers like DSW in favor of direct-to-consumer (DTC) channels has had mixed results. While DTC sales offer higher margins, the abrupt shift disrupted distribution networks and alienated some consumers.

Additionally, emerging brands such as Hoka and On are gaining traction with innovative designs that appeal to younger demographics seeking performance-focused footwear.

Jay Woods, Chief Global Strategist at Freedom Capital Markets, remarked: “The strategy is outlined, but they have yet to see tangible results.”

What’s Next for Nike?

CEO Elliott Hill’s "Win Now" Strategy

Elliott Hill, who took over as CEO in late 2024, has introduced a turnaround plan focused on:

- Revitalizing classic franchises while introducing new product lines like Pegasus Premium.

- Expanding collaborations with high-profile partners such as Kim Kardashian’s NikeSKIMS line.

- Increasing focus on women’s sportswear and diversifying product offerings across price points.

Hill acknowledged during the recent earnings call: “While we met expectations we set internally, we’re not satisfied with our overall results... When we lead with sport, we create impact for Nike.”

Rebuilding Consumer Confidence

Nike aims to regain lost market share through:

- Enhanced marketing efforts targeting female athletes.

- A renewed focus on sustainability initiatives to appeal to eco-conscious consumers.

- Improved inventory management to stabilize pricing and reduce markdowns.

Conclusion

Nike’s current challenges underscore the complexities of navigating a global business amid shifting consumer preferences and economic uncertainties. While the company remains a dominant force in sportswear, its declining sales signal an urgent need for strategic realignment.

As CEO Elliott Hill works to execute his "Win Now" strategy, investors will be closely watching for signs of stabilization in key markets like China and North America. Whether Nike can regain its footing will depend on its ability to innovate while addressing core operational inefficiencies.

For now, the road ahead looks more like a marathon than a sprint—a sentiment echoed by analysts who believe it could take several quarters before Nike sees meaningful recovery.